Online Trade Schools

Find an online trade school program and take the first steps toward a new career.

ONLINE TRADE SCHOOLS COULD PREPARE YOU FOR FAST GROWING CAREERS IN LESS TIME THAN A 4-YEAR DEGREE

What Is Trade School?

Trade schools and other vocational programs offer training for practical skills that are for a specific job. Examples include careers like electricians, paralegals and occupational therapy assistants.

Many schools offer short term technical programs of one year or less. These programs culminate in a certificate, diploma or non degree post secondary award. Community colleges also offer vocational programs. These programs typically take about two years and culminate with an associate degree.

Can You Attend Programs Online?

Yes, online trade school and vocational training is available. Mobile friendly, many trade programs cater to the at work adult with a busy life.

Distance learning programs are often self paced, so you can set a graduation goal that is right for you. Some may even have tools that help you set a realistic pace and stay motivated to finish your program.

What Programs Are Offered?

Today’s career diplomas cater to a wide range of interests and career paths. Examples include residential electrician, plumbing, welding, HVAC, home health aid, carpentry and dental hygienist.

There are many more programs available, some of which may prepare you for one of the fastest growing careers in the US!

Trade School Benefits

Studying at a trade school may prep you for one of about 99 jobs that require higher education and middle skills.

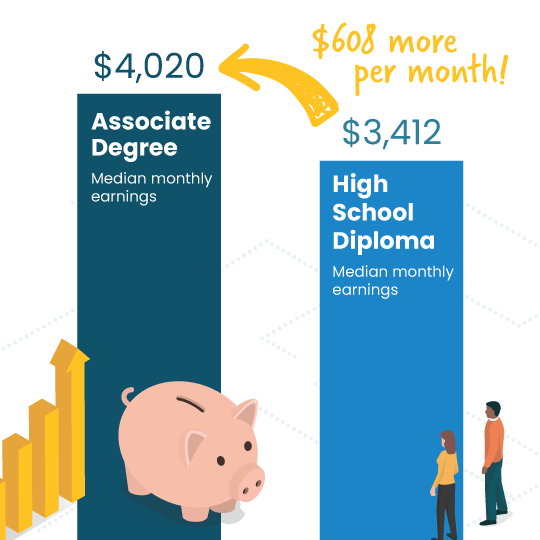

A career oriented degree program may also boost your earnings. On average, people with an associate degree or some college coursework earn more than those with only a high school diploma. The difference in pay goes up to about $496 per month which adds up over a lifetime.

Today’s skilled trade programs cater to a wide range of interests and talents. Many of them are offered for fast growing careers, and many are available online.

Fast Growing Careers

Many trade and vocational related jobs have fast growth rates. This means there is a high demand for workers to fill positions. So, it may lead to an easier job search for you when it comes time.

Wind Turbine Technicians

| 2022 Median Pay | $57,320, $27.56/hr |

| Job Growth | 44% (much faster than avg) |

| New Jobs Expected | 4,900 from ’21 to ’31 |

How to Become a Wind Turbine Technician

Wind turbine technicians, also known as windtechs, maintain, install, and repair wind turbines.

Wind turbine technicians commonly enroll in technical schools or community colleges, where they can opt to pursue either a postsecondary certificate in wind energy technology or work toward obtaining an associate degree.

Courses in a program may include:

- Fundamentals of Electricity

- Wind Turbine Mechanical Systems

- Principles of Wind Energy

- Fundamentals of Hydraulics

- Industrial Safety

Source: Bureau of Labor Statistics (BLS)

Solar Photovoltaic Installers

| 2022 Median Pay | $47,670, $22.92/hr |

| Job Growth | 27% (much faster than avg) |

| New Jobs Expected | 4,600 from ’21 to ’31 |

How to Become a Solar Photovoltaic Installer

Solar photovoltaic (PV) installers assemble, install, and maintain solar panel systems on rooftops or other structures.

Although most installers need a high school diploma and typically receive on the job training lasting up to 1 year, some candidates take courses at a technical school or community college.

Courses in a program may include:

- Solar Panel System Sizing and Design

- The Components of Solar Thermal Heating Systems

- Calculating the Size of Solar Thermal Heating Systems

- Installing Solar Thermal Heating Systems

Source: BLS

Home Health and Personal Care Aides

| 2022 Median Pay | $30,180, $14.51/hr |

| Job Growth | 25% (much faster than avg) |

| New Jobs Expected | 924,000 from ’21 to ’31 |

How to Become a Home Health and Personal Care Aide

Home health aides and personal care aides help people with disabilities, chronic illnesses, or cognitive impairment by assisting in their daily living activities.

Home health aides typically need a high school diploma or GED. There are also non degree award programs at community colleges and vocational schools. Those working in certified home health or hospice agencies must complete formal training and pass a standardized test.

Courses in a program may include:

- Introduction to the Home Health Aide Role

- Therapeutic Communication Skills

- Home Care Procedures

- Nutrition

- Meeting Clients’ Needs

- Law, Ethics, and Confidentiality

Source: BLS

Veterinary Technologists and Technicians

| 2022 Median Pay | $38,240, $18.38/hr |

| Job Growth | 24% (much faster than avg) |

| New Jobs Expected | 24,100 from ’21 to ’31 |

How to Become a Veterinary Technologist or Technician

Vet techs do medical tests that help diagnose animals’ injuries and illnesses.

Veterinary technicians must complete a post secondary program in veterinary technology. A vet tech needs a 2 year associates degree, but, a vet assistant couple complete a diploma program. Typically, they must also take an exam to become registered, licensed, or certified, depending on the criteria of the state in which they work.

Courses in a program may include:

- Animal Anatomy

- Medical Math

- Vet Office Management

- Animal Nutrition

- Reproduction, Genetics, and Aging

Source: BLS

Physical Therapist Assistants and Aides

| 2022 Median Pay | $49,180, $23.64/hr |

| Job Growth | 24% (much faster than avg) |

| New Jobs Expected | 33,900 from ’21 to ’31 |

How to Become a Physical Therapist Assistant or Aide

Physical therapist assistants and aides works under the supervision of a licensed physical therapist to provide essential support in the rehabilitation and treatment of patients with physical injuries, illnesses, or disabilities. Physical therapist assistants, also known as PTAs, are involved in the direct care of patients, while physical therapist aides tend to have responsibilities indirectly related to patient care, such preparing treatment areas and performing administrative tasks.

Physical therapist assistants are required to earn an associate degree from a program accredited by the Commission on Accreditation in Physical Therapy Education. Such programs generally last about 2 years and include supervised clinical work. Physical therapist aides typically need a high school diploma or equivalent, often along with a short period of on-the-job training (about a week to a month).

Courses in a program may include:

- Principles of Kinesiology

- Anatomy and Physiology

- Medical Terminology

- Therapeutic Modalities

- Administration in Physical Therapy

Source: BLS

Manicurists and

Pedicurists

| 2022 Median Pay | $31,130, $14.97/hr |

| Job Growth | 22% (much faster than avg) |

| New Jobs Expected | 36,600 from ’21 to ’31 |

How to Become a Manicurist or Pedicurist

A manicurist/pedicurist is a skilled professional who specializes in providing cosmetic and therapeutic nail care services for clients. They focus on grooming and enhancing the appearance of clients’ fingernails and toenails, as well as providing relaxation and therapeutic benefits through their treatments.

Manicurists and pedicurists must be licensed by their state in order to practice. They need to complete a state-approved cosmetology or nail technician program and then pass a state exam. Programs typically last anywhere from 3 to 9 months.

Courses in a program may include:

- Manicure and Pedicure Techniques

- Nail Art

- Salon Business and Professionalism

- Sterilization and Disinfection

Source: BLS

Massage Therapists

| 2022 Median Pay | $49,860, $23.97/hr |

| Job Growth | 20% (much faster than avg) |

| New Jobs Expected | 29,900 from ’21 to ’31 |

How to Become a Massage Therapist

Massage therapists specialize in providing therapeutic touch and manual manipulation of the body’s muscles and soft tissues to promote relaxation, reduce stress, alleviate pain, and improve overall well-being. There are variety of massage techniques, such as Swedish massage, deep tissue massage, sports massage, Thai massage, aromatherapy massage, and others.

They typically complete a postsecondary educational program that integrates both academic study and hands-on experience. However, the criteria and prerequisites differ from state to state. The majority of states have regulations governing massage therapy, mandating that practitioners hold a valid license or certification.

In addition to learning a variety of massage techniques, courses in a program may include:

- Anatomy and Physiology

- Spa Therapies

- Massage Therapy for Special Populations

- Massage Business Management

Source: BLS

Travel Agents

| 2022 Median Pay | $46,400, $22.31/hr |

| Job Growth | 20% (much faster than avg) |

| New Jobs Expected | 9,100 from ’21 to ’31 |

How to Become a Travel Agent

Travel agents assist individuals and groups in planning and arranging their travel experiences. They offer advice on destinations, design detailed travel itineraries, and book reservations.

While some employers might only require a high school diploma, others may prefer to hire candidates who have earned a certificate, career diploma, or degree in the travel industry. Such programs could be found at community colleges, vocational schools, and industry associations. Certification, although not required, is available through a variety of organizations.

Courses in a program may Include:- World Geography

- Types of Travel Clients

- Computer Reservations Systems

- Travel Products Including Transportation, Accommodations, and Cruises

- Industry Regulating Agencies

- Tourism Sales and Marketing

Source: BLS

Fitness Trainers and Instructors

| 2022 Median Pay | $45,380, $21.82/hr |

| Job Growth | 19% (much faster than avg) |

| New Jobs Expected | 57,800 from ’21 to ’31 |

How to Become a Fitness Trainer or Instructor

Fitness trainers and instructors help individuals achieve their health and fitness goals through personalized exercise programs and guidance. Their responsibilities encompass a range of tasks aimed at promoting physical well-being, improving fitness levels, and motivating clients to adopt healthy lifestyles.

Many employers prefer to hire candidates who have a certificate or degree. Certificate programs are offered by a number of industry associations; community colleges and universities offer associate and bachelor’s degree programs. Fitness trainers or instructors usually earn certification in their specialty area, and some employers might require it.

Courses in a program may include:

- Basic Anatomy

- Kinesiology

- Exercise Science

- Motivating for Performance

- Client Assessment

- Preventing Injury

- Nutrition

Source: BLS

Medical Equipment

Repairers

| 2022 Median Pay | $57,860, $27.82/hr |

| Job Growth | 17% (much faster than avg) |

| New Jobs Expected | 10,000 from ’21 to ’31 |

How to Become a Medical Equipment Repairer

Medical equipment repairers, also known as biomedical equipment technicians (BMETs), repair and maintain a wide range of equipment used in healthcare facilities. They might work on patient monitors, ventilators, medical imaging equipment, hospital beds, electric wheelchairs, and more.

The most common education for these professionals is an associate’s degree in biomedical equipment technology or engineering—however, requirements may vary depending on the type of equipment they specialize in. Those who repair less-complicated equipment, such as hospital beds and electric wheelchairs, may only require a period of on-the-job training, which might last up to a year.

Courses in a program may include:

- Human Biology

- Biomedical Equipment and Technology

- Electronics

- Biomedical Instrumentation

- Electrical Engineering

Source: BLS

Medical Assistants

| 2022 Median Pay | $38,270, $18.40/hr |

| Job Growth | 16% (much faster than avg) |

| New Jobs Expected | 117,800 from ’21 to ’31 |

How to Become a Medical Assistant

Medical assistants complete administrative and clinical tasks in hospitals, offices of physicians, and other healthcare facilities.

Most medical assistants have post secondary education such as a certificate. Employers today may also want Medical Assistants with a certification. The Certified Medical Assistant (CMA), Certified Clinical Medical Assistant (CCMA) are two of 5 options. Look for programs that will prepare you to sit for a certification.

Courses in a program may include:

- Law, Ethics, and Confidentiality in Allied Health

- Medical Coding

- Body Systems and Medical Terms

- Clinical Procedures Theory

- Clinical Procedures Lab

Source: BLS

Paralegals

| 2022 Median Pay | $59,200, $28.46/hr |

| Job Growth | 14% (much faster than avg) |

| New Jobs Expected | 49,900 from ’21 to ’31 |

How to Become a Paralegal

Paralegals and legal assistants carry out tasks to support lawyers. This includes maintaining and organizing files, conducting legal research, and drafting documents.

Most paralegals and legal assistants have at least an associate degree or a certificate in paralegal studies.

Courses in a program may include:

- Legal Terminology

- Ethics

- Investigations and Interviews

- Criminal Litigation

- Family Law

- Wills and Estates

Source: BLS

Ultimate Medical Academy

- Ultimate Medical Academy is a nonprofit healthcare career school committed to helping you succeed.

- Online programs available in Medical Administrative Assistant, Medical Billing and Coding, Health & Human Services.

- UMA programs prepare students to sit for relevant certification exams.

Types of Programs

Vocational programs vary in length, format (full time, part time) and award granted. Below is an overview of the major types of programs.

Apprenticeship

An apprenticeship is a kind of hands on training. It partners a student with a licensed trade professional who watches over their work. For example, an electrician or an HVACR tech. Apprenticeships add formal on the job training to other academic instruction. In some cases they also pay a wage.

Many apprenticeships last between two and six years. After this period of time, a person may need to take a licensure exam to be able to work without a supervisor.

Prep for Licensure / Certification

A certification program is often a study guide for a licensure exam. The classes in the program tend to target areas you need to master to pass the exam. And passing the exam may be the way to achieve your certification.

Many certification and pre licensure programs take only a few weeks. But longer ones may take months and may include a supervised experience. One example is a physical therapist assistant (PTA) program. These two year programs often prep you to take the National Physical Therapy Examination (NPTE) and PTA licensure.

Diploma or Certificate

Many trade and vocational schools award diplomas. Also known as certificates and non degree awards.

These programs are often short (from a few weeks to a year). They cover classes that prepare you to pursue a job in a specific trade field. Examples would include medical assistant, dental assistant, paralegal, HVAC tech or Vet Assistant.

Associate Degree

Technical schools as well as community colleges also offer two year associate degrees. In general, there are two kinds of associate degree programs. Applied Science and Academic Transfer (AA or AS degrees). Both of these include general education classes and a few basic ones in your major. As a rule, the goal is to help students shave time and expense off a bachelor’s degree program.

Prospective students who want to learn a trade would pursue an Applied science (AAS) program. Like a diploma, it allows students to focus on a specific vocation. Unlike the AA or AS, these programs are often terminal. This means the goal of this program is to prep you to pursue your chosen field when you graduate. Credits are not usually intended to transfer to a bachelors degree.

HOW IS HANDS-ON TRAINING INTEGRATED INTO ONLINE PROGRAMS?

Even if your trade program courses are available online, hands-on training may be needed. This training helps to develop skills you can’t pick up in front of a computer screen. The way each program weaves clinical and hands on training varies. But there are at least three common scenarios.

- Hybrid Vocational Programs: In a hybrid vocational program, you take some classes online. Then also attend campus for things like skills labs. The events are part of your syllabus, so you can plan in advance.

- Vocational School Partnerships: Schools may also partner with facilities around the United States. This allows the school to connect you with the hands-on training you need in a suitable local setting.

- Student Choice: Not all schools partner with facilities. Instead they may leave it up to you and your advisor. Your school, in this case, may give the final stamp of approval.

Is Financial Aid Available For Vocational Training?

Yes! Financial aid is available to eligible students.

Grants

While you are earning your career diploma, you may receive Pell Grants and Federal Supplemental Educational Opportunity Grants (FSEOG).

The Pell Grant is a need based grant for low income students. It is free money that doesn’t need to be repaid. (Some terms may apply). Each year, the amount of a Pell Grant can vary. For the 2023 to 2024 award year, the max is $7,395.

FSEOG Grants are available at schools that take part in the programs. If you qualify, you might receive between $100 and $4,000 a year. The amounts depend on your financial need, when you apply, the amount of other aid you get, and the availability of funds at your school.

To apply for these programs, all you have to do is fill out the Free Application for Federal Student Aid. In fact, you should fill out the FAFSA before doing anything else.

Scholarships & Loans

Scholarships are another form of financial aid to investigate. Like grants, the money is free and there are many providers. Some come from trade schools themselves, while others are from private sources, agencies etc.

There are also loans available for some vocational programs. Sallie Mae recently rolled out a new loan aimed at helping students enrolled in less than four year degree programs.

How to Identify a Good Online School – 6 Things to Look For

Accreditation

An accredited online school meets guidelines for academics and training. This is monitored by a third party agency. When a school is accredited, they are also eligible to take part in federal aid programs. Since not all vocational schools have up to date accreditation, you should check the U.S. Department of Education. They have a list of Nationally Recognized Accrediting Agencies.

Licensure

In many states technical and career colleges must have a license to operate. This license allows them to offer vocational courses and programs within the law. Licensed schools may also provide training that certification boards insist on. If unclear, check which state agency handles educational licensing.

Student Services

A good online school also has student services in place. These services include things like tech support for online students. Some also offer tutoring, financial aid, job placement and access to libraries.

Qualified Faculty

The academic and professional background of the school’s faculty is another indicator of quality. As is how they interact with students. Are the courses taught by someone who has industry knowledge related to your program? Do they have any related training or certifications? Are they accessible? How do you contact them? Do they hold online office hours? Things of this nature are vital to nail down.

Practical Curriculum

Reputable schools should set you up with the know how to help you succeed in your chosen trade. This has a few parts to it. First, all course material should be presented clearly so you are able to easily follow it. Second, the courses you take should be focused on skills that you will need from day to day in your job.

Hands-On Experience

Many career schools mix classes with hands-on experience. In a quality school, these should be easy enough to arrange and get help with.

51 Online Trade Schools 2023 and Beyond

To help you narrow school search results, we compiled a list of online trade schools based on the highest total number of students taking online programs and courses at schools that offer vocation based degrees, diplomas and certificates. Our methods used data from College Scorecard and the National Center for Education Statistics. All average annual cost numbers includes tuition, living costs, books, and fees minus the average grants and scholarships for federal financial aid recipients.

1Cuyahoga Community College District

Cuyahoga Community College is home to 23,440 students who are pursuing Associates and other non degree awards. Of those students 50% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 29%. The average annual cost is $5,296. Medical coding and court reporting are two programs that are offered online. Other programs such as welding, allied health and nursing require on campus classes.

| Top Vocation Programs | Median Earnings After Grad | Monthly Earnings | Median Total Debt | Monthly Loan |

|---|---|---|---|---|

| RN | $61,212 | $5,101 | $9,484 | $101 / month |

| ALLIED HEALTH DIAGNOSTIC & TREATMENT PROFESSIONS | $53,917 | $4,493 | 10,925 | 116 |

| Electrical Engineering Technologies/Technicians | $59,249 | $4,937 | NA | NA |

| Information Science/Studies | $54,104 | $4,509 | NA | NA |

2Rio Salado College

Rio Salado College is home to 18,304 students who are pursuing Associates and other non degree awards. Of those students 58% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 13%. The average annual cost is $9,226. Paralegal, dental programs and early childhood management that are are few of the programs offered online.

| Top Vocation Programs | Median Earnings After Grad | Monthly Earnings | Median Total Debt | Monthly Loan |

|---|---|---|---|---|

| CRIMINAL JUSTICE & CORRECTIONS | $49,854 | $4,155 | NA | NA |

| LEGAL SUPPORT SERVICES | $34,959 | $2,913 | NA | NA |

| MENTAL & SOCIAL HEALTH | $41,068 | $3,422 | NA | NA |

3Ivy Tech Community College

Ivy Tech Community College is home to 72,006 students who are pursuing Associates and other non degree awards. Of those students 54% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 20%. The average annual cost is $6,685. Paralegal, human services, health information technology that are are few of the programs offered online.

| Top Vocation Programs | Median Earnings After Grad | Monthly Earnings | Median Total Debt | Monthly Loan |

|---|---|---|---|---|

| RN | $60,435 | $5,036 | $12,000 | $127 / month |

| MEDICAL ADMIN SERVICES | $32,964 | $2,747 | $11,500 | $122 / month |

| MEDICAL ASSISTING | $31,756 | $2,646 | $10,500 | $111 / month |

| ALLIED HEALTH DIAGNOSTIC & TREATMENT PROFESSIONS | $52,482 | $4,374 | $11,051 | $117 / month |

| ELECTRICAL & POWER TRANSMISSION INSTALLERS | $90,478 | $7,540 | $5,500 | $58 / month |

4Valencia College

Valencia College is home to 46,521 students who are pursuing AS, AA, BS and other non degree awards. Of those students 44% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 44%. The average annual cost is $14,742. MRI Imaging, leadership in healthcare that are are few of the programs offered online, with the exception of lab and clinical practicums.

| Top Vocation Programs | Median Earnings After Grad | Monthly Earnings | Median Total Debt | Monthly Loan |

|---|---|---|---|---|

| ALLIED HEALTH DIAGNOSTIC & TREATMENT PROFESSIONS | $60,701 | $5,058 | $12,255 | $130 / month |

| LEGAL SUPPORT SERVICES | $40,281 | $3,357 | $13,599 | $144 / month |

| HOSPITALITY MANAGEMENT | $32,606 | $2,717 | $11,107 | $118 / month |

| CRIMINAL JUSTICE & CORRECTIONS | $31,012 | $2,584 | $12,500 | $133 / month |

| CULINARY ARTS | $28,549 | $2,379 | $11,422 | $121 / month |

5Central Texas College

Central Texas College is home to 16,073 students who are pursuing AS, AA, BS and other non degree awards. Of those students 57% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 14%. The average annual cost is $8,626. A few of the vocational online programs are medical billing and coding, paralegal and child development.

| Median Earnings After Grad | Monthly Earnings | Median Total Debt | Monthly Loan | |

|---|---|---|---|---|

| AVERAGE | $37,800 – $60,800 | NA | $6,750 | $72/ month |

6Des Moines Area Community College

Des Moines Area Community College is home to 23,474 students. DMACC offers over 200 degrees, diplomas and certificates, they partner with online provider Ed2go to offer online certificate programs. Of those students 30% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 27%. The average annual cost is $10,489. A few of the online career training programs include HVACR tech, welder technician, medical assistant and electronic health records specialist.

| Top Vocation Programs | Median Earnings After Grad | Monthly Earnings | Median Total Debt | Monthly Loan |

|---|---|---|---|---|

| PRECISION METAL WORKING | $43,506 | $3,626 | $5,500 | $58 / month |

| PRACTICAL NURSING | $54,641 | $4,553 | NA | NA |

| VEHICLE MAINTENANCE AND REPAIR | $56,356 | $4,696 | $8,770 | $93 / month |

| MEDICAL ASSISTING | 31,130 | $2,594 | $10,265 | $109 / month |

| CULINARY ARTS | $30,175 | $2,515 | $8,334 | $88 / month |

7Central New Mexico Community College

Central New Mexico Community College is home to 23,553 students offering AA, AAS, AS and certificate programs. Of those students 42% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 28%. The average annual cost is $3,663. A few of the online certificate programs include bookkeeping, health information management systems, data center technician and immigration laws, policies and procedures.

| Top Vocation Programs | Median Earnings After Grad | Monthly Earnings | Median Total Debt | Monthly Loan |

|---|---|---|---|---|

| RN | $72,221 | $6,018 | $8,666 | $92 / month |

| ALLIED HEALTH DIAGNOSTIC & TREATMENT PROFESSIONS | $52,421 | $4,368 | $5,374 | $57 / month |

| ELECTRICAL & POWER TRANSMISSION INSTALLERS | $40,129 | $3,344 | NA | NA |

| LEGAL SUPPORT SERVICE | $35,663 | $2,972 | NA | NA |

| HVACR | $43,793 | $3,649 | NA | NA |

8Metropolitan Community College Area

Metropolitan Community College Area is home to 14,913 students offering AA, AAS, AS and certificate programs. Of those students 30% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 15%. The average annual cost is $4,915. A few of the online AAS AND certificate programs include probation and supervision, health care manager, health information management technician and bookkeeping.

| Top Vocation Programs | Median Earnings After Grad | Monthly Earnings | Median Total Debt | Monthly Loan |

|---|---|---|---|---|

| ELECTRICAL & POWER TRANSMISSION INSTALLERS | $79,318 | $6,610 | $8,628 | $91 / month |

| RN | $68,178 | $5,682 | $7,646 | $81 / month |

| DESIGN AND APPLIED ARTS | $32,716 | $2,726 | $8,831 | $94 / month |

| CRIMINAL JUSTICE & CORRECTIONS | $37,863 | $3,155 | $11,424 | $121 / month |

| HEALTH AND MEDICAL ADMIN SERVICES | $38,888 | $3,241 | NA | NA |

9Columbus State Community College

Columbus State Community College is home to 27,343 students offering AA, AAS, AS, ATS and certificate programs. Of those students 35% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 21%. The average annual cost is $7,254.

| Median Earnings After Grad | Monthly Earnings | Median Total Debt | Monthly Loan | |

|---|---|---|---|---|

| AVERAGE | $38,308 | NA | $8,749 | $93/ month |

10Amarillo College

Amarillo College is home to 9,854 students. The school offers primarily AAS and certificate programs. Of those students 50% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 30%. The average annual cost is $4,956. Some programs can be taken entirely online such as an AAS in radiation therapy. The school also works with Ed2Go, an online trade school partner, for many online course options from HVACR to Medical assisting.

| Top Vocation Programs | Median Earnings After Grad | Monthly Earnings | Median Total Debt | Monthly Loan |

|---|---|---|---|---|

| VEHICLE MAINTENANCE AND REPAIR TECH | $43,076 | $3,590 | $9,500 | $101 / month |

| ALLIED HEALTH DIAGNOSTIC & TREATMENT PROFESSIONS | $52,224 | $4,352 | $12,817 | $136 / month |

| DENTAL SUPPORT SERVICES | $59,564 | $4,964 | $12,000 | $127 / month |

| CRIMINAL JUSTICE & CORRECTIONS | $50,246 | $4,187 | NA | NA |

| MEDICAL ASSISTING | $52,929 | $4,411 | $13,304 | $141 / month |

11Broward College

Broward College is home to 40,784 students. The school offers primarily AAS and certificate programs. Of those students 30% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 34%. The average annual cost is $14,577.

| Median Earnings After Grad | Monthly Earnings | Median Total Debt | Monthly Loan | |

|---|---|---|---|---|

| AVERAGE | $39,780 | NA | $7,500 | $80/ month |

12Northern Virginia Community College

Northern Virginia Community College is home to 50,929 students. Of those students 24% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 26%. The average annual cost is $9,884. VCC primarily offers Associates of Applied Science programs as well as Career Studies Certificates. Online certificates include bookkeeping, early childhood development and cyber security.

| Top Vocation Programs | Median Earnings After Grad | Monthly Earnings | Median Total Debt | Monthly Loan |

|---|---|---|---|---|

| COMPUTER SCIENCE | $81,847 | $6,821 | $9,598 | $102 / month |

| DENTAL SUPPORT | $75,837 | $6,320 | $20,250 | $215 / month |

| ENGINEERING (GENERAL) | $72,365 | $6,030 | $9,282 | $98 / month |

| ALLIED HEALTH DIAGNOSTIC & TREATMENT PROFESSIONS | $68,377 | $5,698 | $12,000 | $127 / month |

| RN | $68,298 | $5,692 | $16,278 | $173 / month |

13Austin Community College District

Austin Community College District is home to 40,799 students. Of those students 29% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 12%. The average annual cost is $6,612. ACC associate degrees, university transfer credits and career technical certificates. Online programs include criminal justice, real estate, web development and geographic information systems.

| Top Vocation Programs | Median Earnings After Grad | Monthly Earnings | Median Total Debt | Monthly Loan |

|---|---|---|---|---|

| ACCOUNTING SERVICES | $89,915 | $7,493 | NA | NA |

| ALLIED HEALTH DIAGNOSTIC & TREATMENT PROFESSIONS | $63,522 | $5,294 | $9,625 | $102 / month |

| COMPUTER PROGRAMMING | $76,625 | $6,385 | NA | NA |

| RN | $67,987 | $5,666 | $14,162 | $150 / month |

14St Petersburg College

St Petersburg College is home to 29,183 students. Of those students 58% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 35%. The average annual cost is $2,212. This school offers more than 110 degree and certificate programs, as well as many high demand, high skill workforce certifications. Online programs include Vet Tech, medical coder, fire science and health information technology.

| Top Vocation Programs | Median Earnings After Grad | Monthly Earnings | Median Total Debt | Monthly Loan |

|---|---|---|---|---|

| FIRE PROTECTION | 84,317 | 7,026 | NA | NA |

| ALLIED HEALTH DIAGNOSTIC & TREATMENT PROFESSIONS | $60,493 | $5,041 | $12,757 | $135 / month |

| RN | 75,584 | 6,299 | $15,578 | $165 / month |

| IT ADMINISTRATION AND MANAGEMENT | $58,990 | $4,916 | $26,285 | $279 / month |

15Central Piedmont Community College

Central Piedmont Community College is home to 18,824 students. Of those students 57% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 21%. The average annual cost is $5,750. This school offers nearly 300 degrees, certificates, diplomas, and non credit continuing education programs. Online programs include construction management, fire protection, HIT and game design.

| Top Vocation Programs | Median Earnings After Grad | Monthly Earnings | Median Total Debt | Monthly Loan |

|---|---|---|---|---|

| DENTAL SUPPORT | $52,864 | $4,405 | NA | NA |

| ALLIED HEALTH DIAGNOSTIC & TREATMENT PROFESSIONS | $55,776 | $4,648 | NA | NA |

| COMPUTER SCIENCE | $50,825 | $4,235 | NA | NA |

| RN | $61,843 | $5,154 | NA | NA |

16Lone Star College System

Lonestar College is home to 73,499 students who are pursuing various AAS and other non degree awards. Of those students 39% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 17%. The average annual cost is $8,654. Accreditation Info.

| Top Vocation Programs | Median Earnings After Grad | Monthly Earnings | Median Total Debt | Monthly Loan |

|---|---|---|---|---|

| RN | $75,488 | $6,291 | $9,000 | $95 / month |

| ALLIED HEALTH DIAGNOSTIC & TREATMENT PROFESSIONS | $71,102 | $5,925 | $5,250 | $56 / month |

| MEDICAL ASSISTING | $51,431 | $4,286 | $8,042 | $85 / month |

| FIRE PROTECTION | $59,053 | $4,921 | NA | NA |

| PRACTICAL NURSING & NURSE ASSISTANT | $54,983 | $4,582 | $9,312 | $99 / month |

17Tarrant County College

Tarrant County College is home to 51,100 students who are pursuing various AAS and other non degree awards. Of those students 23% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 21%. The average annual cost is $6,326. Many of the non degree programs carry specialized program specific accreditation. The school offers everything from automotive technology, medical assistant programs, and HVAC to welding and vet tech..

| Top Vocation Programs | Median Earnings After Grad | Monthly Earnings | Median Total Debt | Monthly Loan |

|---|---|---|---|---|

| MEDICAL ASSISTING | $58,121/td> | $4,843 | NA | NA |

| DENTAL SUPPORT | $57,808 | $4,817 | NA | NA |

| RN | $66,716 | $5,560 | $11,368 | $121 / month |

| ALLIED HEALTH DIAGNOSTIC & TREATMENT PROFESSIONS | $61,292 | $5,108 | $14,683 | $156 / month |

| FIRE PROTECTION | $82,736 | $6,895 | NA | NA |

18Johnson County Community College

Johnson County Community College is home to 18,373 students. Of those students 31% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 28%. The average annual cost is $13,249. The online trade school portion of the college offers many online programs including, nursing aide, vet tech, construction, and HVAC certifications..

| Top Vocation Programs | Median Earnings After Grad | Monthly Earnings | Median Total Debt | Monthly Loan |

|---|---|---|---|---|

| COMPUTER SYSTEMS | $61,132 | $5,094 | NA | NA |

| GROUND TRANSPORT | $60,000 | $5,000 | NA | NA |

| ALLIED HEALTH DIAGNOSTIC & TREATMENT PROFESSIONS | $57,127 | $4,761 | $10,750 | $114 / month |

| HVACR | $57,488 | $4,791 | NA | NA |

| RN | $60,996 | $5,083 | $9,000 | $95 / month |

19Lake Region State College

Lake Region State College is home to 2,072 students who are pursuing various AAS and other non degree awards. Of those students 88% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 50%. The average annual cost is $10,030. The school offers many online programs including, nursing assistant, medical assistant, wind technician, and automotive mechanics..

| Top Vocation Programs | Median Earnings After Grad | Monthly Earnings | Median Total Debt | Monthly Loan |

|---|---|---|---|---|

| CRIMINAL JUSTICE & CORRECTIONS | $58,241 | $4,853 | $4,750 | $50 / month |

| RN | $67,515 | $5,626 | $13,000 | $138 / month |

| AGRICULTURAL BUSINESS AND MANAGEMENT | $42,742 | $3,562 | NA | NA |

20College of Southern Nevada

College of Southern Nevada is home to 34,169 students. Of those students 47% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 21%. The average annual cost is $6,904. The school offers many online programs including, casino management, criminal justice, early childhood education, and medical transcription..

| Top Vocation Programs | Median Earnings After Grad | Monthly Earnings | Median Total Debt | Monthly Loan |

|---|---|---|---|---|

| DENTAL SUPPORT | $71,702 | $5,975 | NA | NA |

| RN | $80,225 | $6,685 | $9,608 | $102 / month |

| ALLIED HEALTH DIAGNOSTIC & TREATMENT PROFESSIONS | $67,852 | $5,654 | $10,433 | $111 / month |

| HVACR | $49,699 | $4,142 | NA | NA |

21San Joaquin Delta College

San Joaquin Delta College is home to 18,209. Of those students 48% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 34%. The average annual cost is $13,760. The school offers online programs including medical transcription, medical billing and medical assistant. .

22South Texas College

South Texas College is home to 31,949 students. Of those students 27% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 31%. The average annual cost is $1,291. The school offers online programs including criminal justice, accounting, computer science and administration of early childhood programs.

23Florida SouthWestern State College

Florida SouthWestern State College is home to 16,556 students who are pursuing various AAS and other non degree awards. Of those students 38% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 33%. The average annual cost is $8,547. The school offers online programs including early childhood education, criminal justice technology and accounting technology.

24Southeast Community College Area

Southeast Community College Area is home to 9,240 students. Of those students 41% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 32%. The average annual cost is $8,818. The school offers online programs including early childhood education, pharmacy technician, radiologic technology and criminal justice.

25Eastern Iowa Community College District

Eastern Iowa Community College District is home to 7,771 students. Of those students 36% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 29%. The average annual cost is $10,401. The school offers many online programs including pharmacy technician, physical therapy aide and highway construction training.

26Sinclair Community College

Sinclair Community College is home to 18,576 students who are pursuing various AAS and other non degree awards. Of those students 37% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 22%. The average annual cost is $4,844. This partially online trade school offers many online programs including medical coding and billing, criminal justice and health information management.

27Daytona State College

Daytona State College is home to 13,737 students. Of those students 53% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 39%. The average annual cost is $8,867. The school offers many online programs including accounting technology, office management, cyber security, and criminal justice.

28Arkansas Tech University

Arkansas Tech University is home to 12,101 students. Of those students 40% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 47%. The average annual cost is $12,191. The school offers many online programs including accounting technology, office management cyber security, and criminal justice.

29Kirkwood Community College

Kirkwood Community College is home to 13,906 students. Of those students 34% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 29%. The average annual cost is $9,422. The school offers online programs including business administration, paralegal studies and water environmental technology.

30Florida State College at Jacksonville

Florida State College at Jacksonville is home to 23,413 students. Of those students 50% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 37%. The average annual cost is $3,296. The school offers online programs including health & human services, education, culinary arts and construction & manufacturing.

31Indian River State College

Indian River State College is home to 16,686 students who are pursuing various AAS and other non degree awards. Of those students 37% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 40%. The average annual cost is $3,966. The school offers online vocational programs including business administration, computer information technology, criminal justice and health information technology.

32Great Basin College

Great Basin College is home to 3,451 students. Of those students, this online trade school has 83% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 31%. The average annual cost is $7,758. The school offers quite a few online programs. Some include land surveying, infant and toddler education, criminal justice corrections and human services.

33Snow College

Snow College is home to 5,514 students. Of those students 48% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 40%. The average annual cost is $8,049 The school does not offer fully online programs, but does offer quite a few online courses. Some include automotive safety, applied GIS and intro to medical terminology.

34Central Carolina Community College

Central Carolina Community College is home to 5,190 students who are pursuing various AAS and other non degree awards. Of those students 53% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 31%. The average annual cost is $5,491. The school offers online programs including business administration, paralegal technology, criminal justice technology and early childhood administration.

35St Philip’s College

St Philip’s College is home to 11,590 students who are pursuing various AAS and other non degree awards. Of those students 45% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 16%. The average annual cost is $5,273. The school offers online vocational programs including teacher certifications, information technology cyber security specialist, health information technology and early childhood and family studies.

36Palo Alto College

Palo Alto College is home to 9852 students. Of those students 46% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 18%. The average annual cost is $4,675. The school offers online programs including administrative assistant, computer support specialist, logistics and supply chain management and business management.

37Barton County Community College

Barton County Community College is home to 4237 students who are pursuing various AAS and other non degree awards. Of those students 51% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 31%. The average annual cost is $9,833. The school offers online programs including business & technology, early childhood education and public safety.

38Lakeland Community College

Lakeland Community College is home to 6865 students. Of those students 41% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 17%. The average annual cost is $7,101. The school offers online programs including fire science technology emergency management planning and administration, it specialist and general accounting.

39Truckee Meadows Community College

Truckee Meadows Community College is home to 10,861 students who are pursuing various AAS and other non degree awards. Of those students 43% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 38%. The average annual cost is $4,863. The school offers online programs including business, criminal justice: law enforcement, logistics management and office management.

40Western Iowa Tech Community College

Truckee Meadows Community College is home to 5,674 students. Of those students 45% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 48%. The average annual cost is $8,236. The school offers online programs including agriculture management, agribusiness technology, technical business management and tax preparer.

41Central Community College

Central Community College is home to 6,354 students. Of those students 45% are enrolled in online programs or are at least taking some courses online. The grad rate at this school is 52%. The average annual cost is $8,690. The school offers online programs including early childhood education, medical coding, accounting, information technology and systems and logistics.

42Leeward Community College

Leeward Community College is home to 6,709 students. Of those students 52% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 25%. The average annual cost is $7,460. The school offers many online programs including accounting, basic logic and programming, business, software development and teaching.

43Saddleback College

Saddleback College is home to 19,421 students. Of those students 54% are enrolled in online programs or are at least taking some courses online. The grad rate at this school is 29%. The average annual cost is $5,379. The school offers many online programs including gerontology, medical coding, healthcare technology optimization, business, and software specialist.

44Coastline Community College

Coastline Community College is home to 10,977 students. Of those students 88% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 20%. The average annual cost is $6,210. The school offers many online programs including educational studies, business, health sciences and wellness and information technology.

45Coastline Community College

North Dakota State College of Science is home to 10,977 students. Of those students 76% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 20%. The average annual cost is $6,210. The school offers the following online programs, business management, health information, information and communications technology, pharmacy technician liberal arts transfer and technical studies.

46Normandale Community College

Normandale Community College is home to 9,784 students. Of those students 38% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 23%. The average annual cost is $11,281. The school offers online course options though online trade school partner Ed2Go. Courses include pharmacy tech, medical billing and coding and medical terminology. They also offer a few fully online degree programs such as an AAS in Business.

47Eastern Florida State College

Eastern Florida State College is home to 15,820 students. Of those students 45% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 42%. The average annual cost is $4,668. The school offers multiple certificate programs online including legal or medical office management, community health worker, magnetic resonance imaging (MRI) and vet practice management.

48Lorain County Community College

Lorain County Community College is home to 10,644 students. Of those students 46% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 22%. The average annual cost is $4,385. They offer multiple online trade school options including medical coding, hospitality operations and payroll clerk.

49Cedar Valley College

Cedar Valley College is home to 8,030 students. Of those students 60% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 33%. The average annual cost is $7,886. The school offers many online programs including vet tech, business marketing, management, business administration and logistics distribution technician.

50Chattahoochee Technical College

Chattahoochee Technical College is home to 8,030 students. Of those students 42% are enrolled in online programs or are at least taking some courses online. The grad rate at this school is 23%. The average annual cost is $3,068. The school offers the following online programs: accounting, business management, business tech, criminal justice tech, logistics and supply chain management.

51Wake Technical Community College

Our last school is Wake Technical Community College. The college is home to 9,618 students who are pursuing various AAS and other non degree awards. Of those students 48% are enrolled in 100% online programs or are at least taking some courses online. The grad rate at this school is 26%. The average annual cost is $5,609. The school offers the following online programs: accounting, human resources, cosmetology, criminal justice tech, web development and supply chain management.

Is enrolling in a trade school a worthwhile decision?

The value of attending a trade school hinges on your budget, goals, and personal circumstances. These institutions can present a cost-effective route to a well-paying career, but job and salary prospects can vary significantly based on your chosen trade school program.

What are the advantages and disadvantages of attending trade school?

Many trade schools offer rolling admissions, allowing you to commence a program within a few weeks, providing a swift and affordable pathway to lucrative careers. On the downside, limitations in career growth, financial aid options, and flexibility can be potential drawbacks.

Why should one consider college over trade school?

If you seek specialized job skills, trade school is undoubtedly the superior choice, especially when considering the overall cost of education. However, if your interests lean towards research or a general pursuit of knowledge, a traditional college setting may be more suitable.